Medicare Tax Rate 2025 High Income - The 2025 medicare tax rate remains at 1.45% for both employees and employers totaling 2.9%, as it was in 2023. Hyundai Palisade 2025 Towing Capacity. Detailed specs and features for the 2025 hyundai palisade including […]

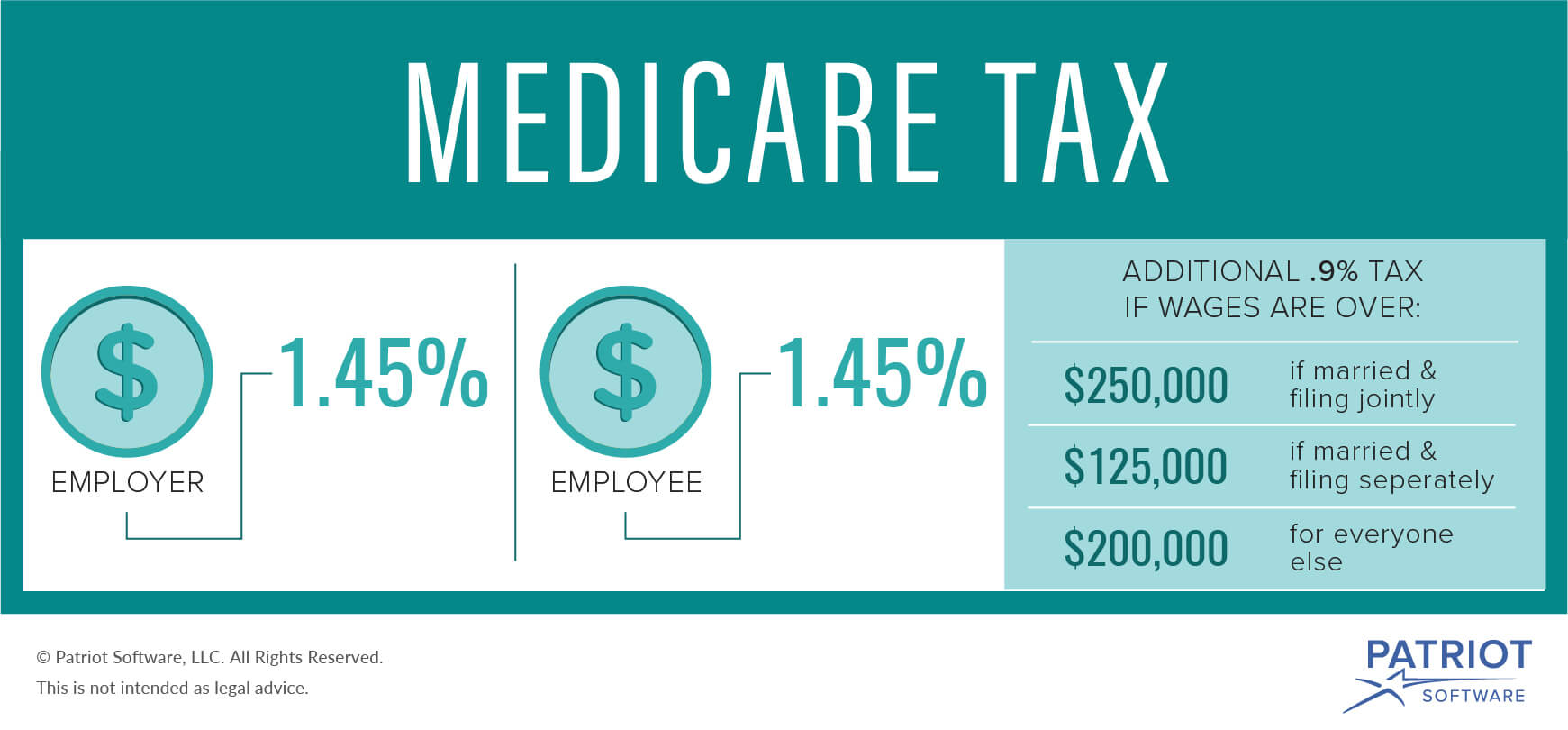

The 2025 medicare tax rate remains at 1.45% for both employees and employers totaling 2.9%, as it was in 2023.

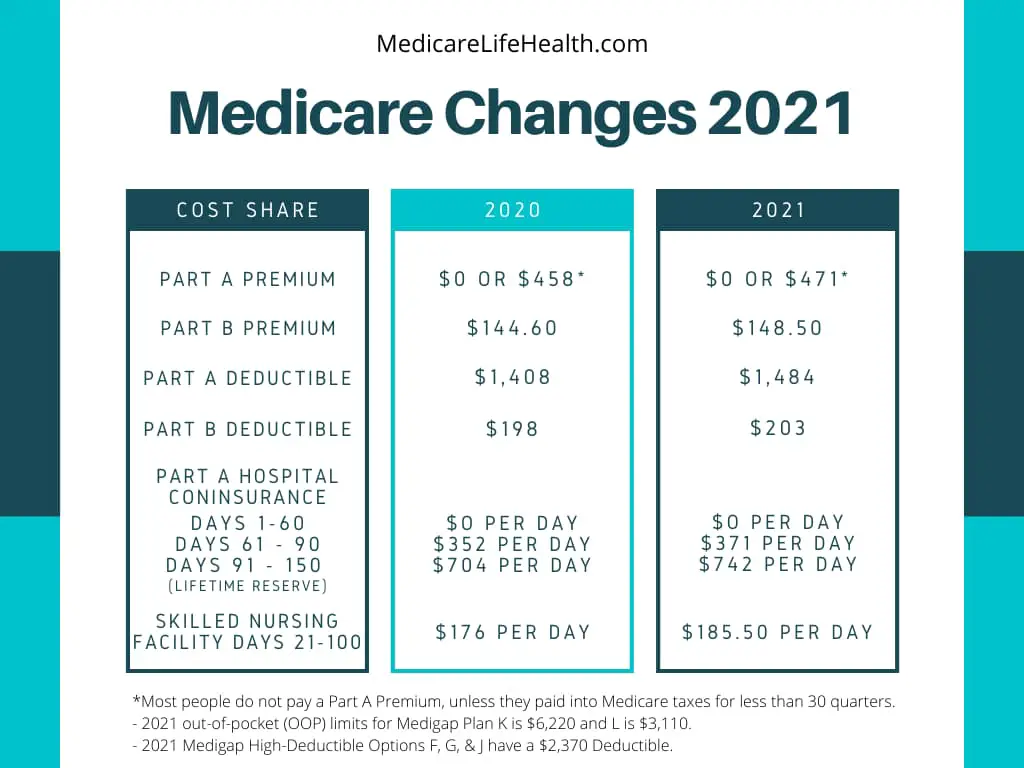

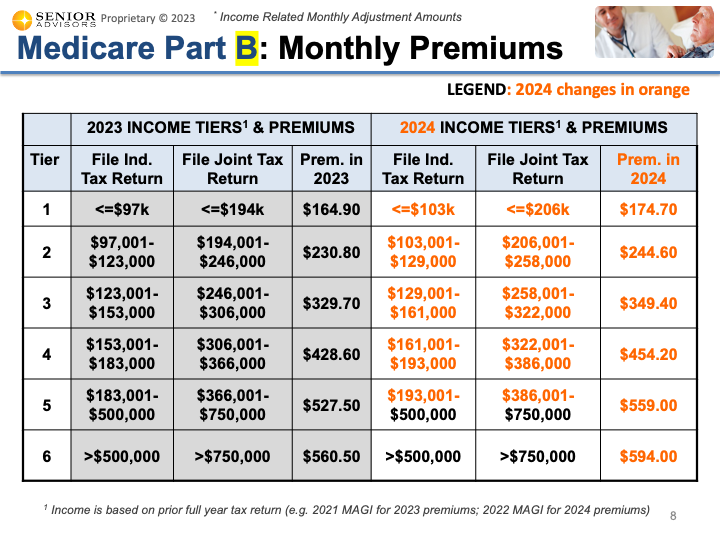

2025 Medicare High Surcharge Glori Kalindi, The fee kicks in if you make more than. The annual deductible for all medicare part b beneficiaries will be $240 in 2025, an increase of $14 from the annual deductible.

The rise in the cost of part d prescription drug plans will vary from state to state.

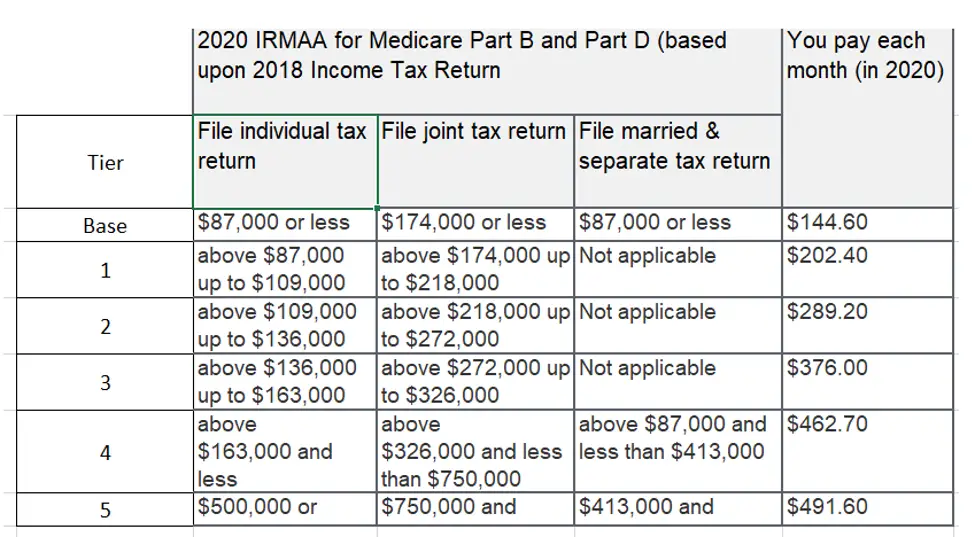

Irmaa 2025 Minni Quintina, For the 2025 tax year, those levels are: Irmaa is a surcharge that people with income above a certain amount must pay in addition to their medicare part b and part d.

Medicare Employee Tax Rate 2025 Lani Shanta, The current rate for medicare is 1.45% for the. The fee kicks in if you make more than.

Medicare Tax Rate 2025 High Income. But starting in 2025, they’ll have to pay 60% or 80%, depending on some rules. It’s a mandatory payroll tax.

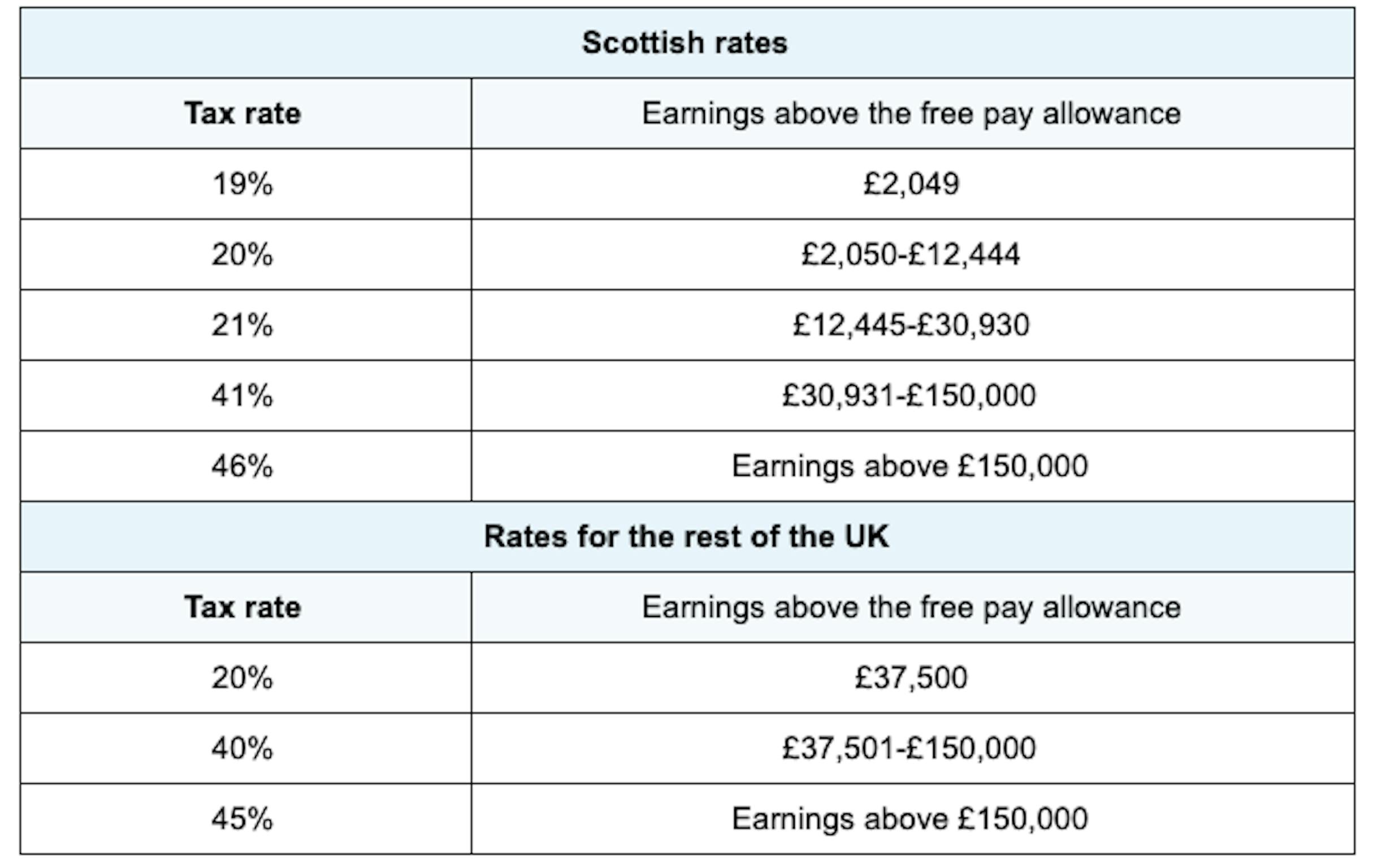

Tax Brackets 2025 Calculator Bevvy, But starting in 2025, they’ll have to pay 60% or 80%, depending on some rules. The tax increase from 3.8% to 5% on earned and unearned income above $400,000 is part of a package of proposals aimed at extending the solvency of.

2025 Tax Brackets And Deductions Jody Millisent, The budget proposes to increase the medicare tax rate on earned and unearned income. [3] there is an additional 0.9% surtax on top of the standard 1.45% medicare.

Medicare Premiums 2025 High Margy Saundra, Let’s say a $75,000 annual salary might sound promising, after factoring in taxes (federal, state, social security, and medicare) at a conservative 35%, that number. For the 2025 tax year, those levels are:

2025 Tax Brackets Aarp Medicare Heda Rachel, For the 2025 tax year, those levels are: The budget proposes to increase the medicare tax rate on earned and unearned income.

Let’s say a $75,000 annual salary might sound promising, after factoring in taxes (federal, state, social security, and medicare) at a conservative 35%, that number.